Table of Contents

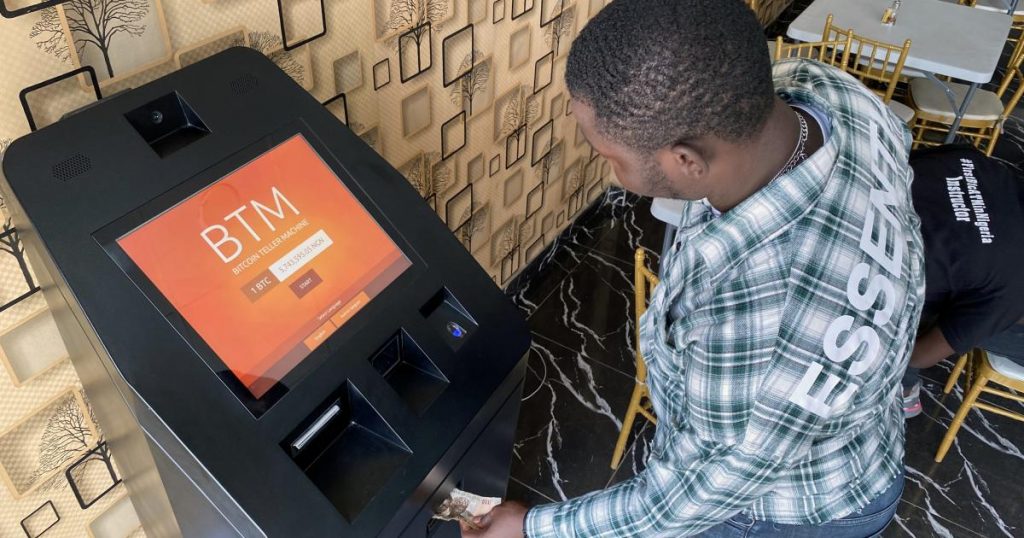

Africa has the smallest cryptocurrency economy in the world. However, the market is developing consistently. The genuine utilization of cryptos can help trade on the landmass, especially among people, private companies, and business visionaries. These were the clients answerable for most of the new expansions in crypto moves recorded in Nigeria, South Africa, and Kenya.

Numerous specialists in blockchain innovation and cryptographic money accept that Africa addresses the following new wilderness for advancement and will contribute fundamentally to worldwide financial development. First, an ever-increasing number of African individuals utilize computerized monetary administrations, such as cash administration M-Pesa. This normally prompts an interest in and acknowledgment of the idea and utilization of digital currency.

For a populace presently engaged with the online world and ready to associate with the innovation that more created economies have been utilizing for more, digital money is the legitimate following stage. Since digital currencies work for the client similarly to versatile cash, it’s simpler for Africans to handle contrasted and individuals in the west who are utilized to long haul monetary incorporation and basic admittance to banking and monetary administrations. Once more, there is an opportunity for monetary models to ‘jump.’

Cryptocurrency popularity in Africa

As Africa has pockets of high joblessness in certain locales, individuals are searching for new, open approaches to bring in cash away from the more conventional areas. Moreover, the pandemic has exacerbated the joblessness level in Africa and from one side of the planet to the other. Yet, the mainland specifically has the best blend of difficulties and opportunities that fits virtual money utilization.

Virtual cash additionally opens up freedoms to work with worldwide organizations. It is simpler for youthful business visionaries to acquire traction in working for significant brands and organizations abroad. It’s likewise possible that digital currency can help African economies in the long haul. These virtual monetary forms work close to homegrown monetary standards, giving economies more outstanding steadiness and flexibility.

The risks of cryptocurrency in Africa

Cryptographic money, by its actual nature, is unpredictable and hard to anticipate. Moreover, as numerous virtual monetary standards remain altogether unregulated, their lawfulness in African nations is muddled. This implies there is no remuneration for loss of assets and no protection for individuals should anything go wrong.

The different disadvantage, especially for transient clients and financial backers, is that digital forms of money can unexpectedly reach a stopping point and droop forcefully. This has happened to Bitcoin, for instance, in various events in the course of the most recent ten years. While the worth has consistently risen again ultimately, this could be an issue for momentary financial backers. Likewise, there is a high probability of individuals being brought into tricks or plans that are false digital currencies.

In Africa, a large part of the take-up is the general associated youthful populace of experts accustomed to utilizing portable cash applications. It’s a simpler switch for them as virtual money is natural and reasonable for these clients. However, for those all around presented with innovation and the idea of crypto, the expectation to absorb information is more limited and significantly more reasonable.

Several factors are leading to the growth and popularity of cryptocurrency in Africa.

Growth in remittances

A major piece of pay for some African nations is settlements from diaspora abroad. As per the World Bank, settlement streams to sub-Saharan Africa for 2019 were near USD 48 billion. Nigeria got practically 50% of the absolute settlements shipped off this district, USD 23.8 billion.

The World Bank report likewise expresses that sending cash in sub-Saharan Africa is costlier than in most different areas. By and large, a sender pays an 8.9% expense to send cash to their nation of origin. Then again, the worldwide norm for similar stands at 6.8%.

Numerous Nigerians are deciding to utilize digital currency to send cash across borders over Naira. Rather than sending cash through banks, they move cash through bitcoin settlement organizations. Sending settlements through these stages bears no expense or is a lot less expensive than banks. Therefore, it assists individuals with keeping away from bank expenses and money transformation charges.

Similarities to mobile money

Another significant reason why Africa has high crypto reception is the absence of a banking foundation. However, portable cash stages, for example, M Pesa, have given financial admittance to many Kenyans over the most recent couple of years. In addition, individuals not approaching customary financial frameworks in provincial regions in Kenya utilize advanced stages to execute.

It is nothing unexpected why digital currency has become appealing to numerous Africans, who are now acquainted with the idea of computerized cash wallets, as per monetary specialists.

There are also some challenges facing the uptake of crypto in Africa.

Financial scams circulating in Africa

Most individuals in Kenya, Nigeria, and other African nations are keen on cryptos because they consider them rewarding speculation with high returns. Unfortunately, numerous Africans effectively succumb to tricks like MMM, which guarantee significant yields and customary pay. As a result, there has been an ascent in the number of phony crypto exchanges and comparable trick sites that guarantee returns for the sake of crypto and other monetary speculations.

People with no association with blockchain advancement or perception of computerized types of cash are at a higher risk of surrendering to crypto-deceivers or contributing through some unsuitable channels. It’s simpler for individuals with some foundation in innovation, yet a segment of African crypto brokers lean towards worthwhile returns instead of fundamental innovation.

There are presently no controllers for digital money in many nations, representing a danger for standard financial backers. There will never be a way out course or method of getting the cashback once the virtual money accidents or there is some trick.

Not a value store in Africa

Crypto isn’t without its difficulties. Right off the bat, Bitcoin and others are not lawful tenders in numerous African nations; numerous African national banks have explained this on various occasions.

That implies there is no wellbeing valve if you lose from your crypto account. Changing over nearby monetary forms into bitcoin is a complicated cycle, frequently interceded by casual agents. Aside from being generally unregulated, digital money is precarious. Transient financial backers are in danger of losing a strong sum because of the destruction of crypto values.

Our verdict on Africa and Cryptocurrency

Concerning the fate of digital money in Africa, it will just keep turning out as a more popular move into the standard in the long run. For instance, Africa’s biggest economy is in Nigeria, which has effectively authorized cryptographic money and started giving administrative rules for digital currency-based new businesses and computerized monetary forms overall.

It could be too soon to say conclusively how broad the utilization of digital money will become in Africa. Almost certainly, it will keep on expanding across the landmass. Over ten years into its reality, digital currencies are starting to discover their direction towards standard use. The rise and growth of cryptocurrency in Africa seem unstoppable and unavoidable. Authorities across the region should work closely with financial institutions to ensure proper regulation. With this uptake in crypto, Africa could soon be overtaking some of the global leaders in crypto.

Please find out more about Crypto’s growth by joining our growing crypto community.

No Comment