Table of Contents

The creators of the world’s first cryptocurrency could not have known that the concept itself would become mega-popular, and the number of available options would quickly exceed a hundred. After classical cryptocurrencies, stablecoins entered the market — a rather interesting phenomenon for both an investor and an ordinary person who wants to conduct various operations in crypto.

Let’s break down what they are, and also analyze the popular stablecoins list to know which tokens you should pay attention to!

Definition

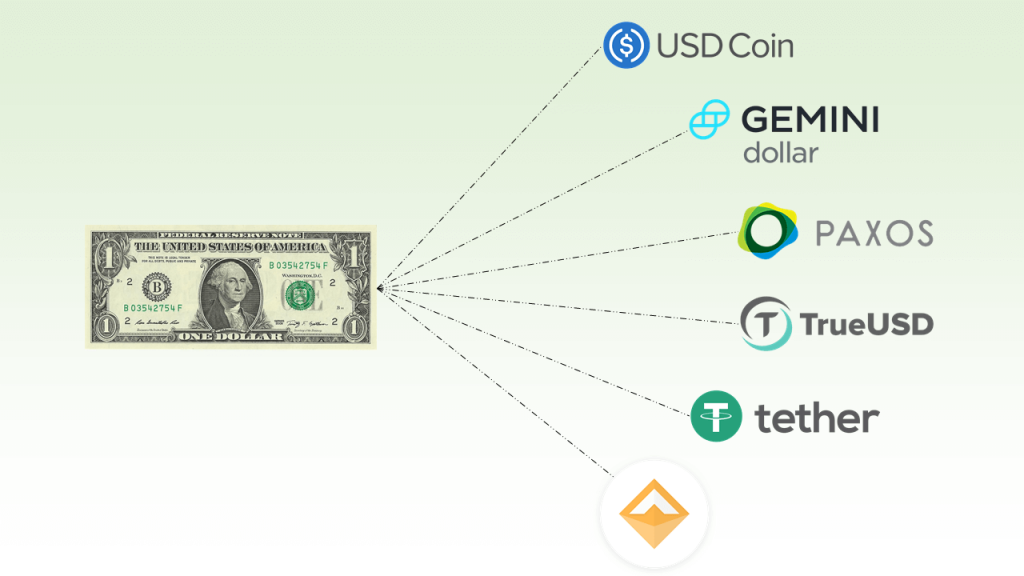

So, a stablecoin is a cryptocurrency or a digital asset, the value of which is directly linked to a fiat asset (for example, world currencies — dollar or euro) or certain valuable materials (for example, precious metals or energy carriers). The first such token saw the world in 2015 thanks to Tether, which created the USDT. Its value correlates with the value of the US dollar as 1 to 1.

Advisory: Do you want to start mining your own cryptocurrency? Have a look at daily ASIC Profitability to know more.

Classification

In general, there are three categories:

- Fiat ones are the first and most popular group, the value of which directly depends on the fiat currency. Examples: USDT, USDC, BUSD.

- Cryptocurrency ones are stablecoins that are based on a cryptocurrency, and their price is pegged to a fiat currency. Example: DAI from MakerDAO.

- Algorithmic ones make a group that applies an underlying algorithm that can increase the supply of coins when their price rises and buy them in the market if the price falls. Example: USD from Terra.

Some experts call central bank digital currencies the fourth category of stablecoins, as they are also pegged to fiat currency and serve as a means of payment and maintaining a stable value.

PS: Start earning passive income by joining the leading crypto exchange platform.

What Option To Choose?

If a customer is going to invest some funds in stablecoins, then experts recommend carefully studying the list of available options in order to select the most promising one. In 2022, the best variants include:

- Tether is the first and largest coin currently. Its market capitalization is about $1.8 billion. Currently, it`s based on the US dollar and supports the euro, but in the near future, the creators will issue coins whose rate will depend on the Japanese yen.

- TrueUSD is another currency with an exchange rate equal to the US dollar. The market capitalization is around $100 million. The currency is available on almost all popular crypto platforms. Also, the creators plan to add TrueEuro and TrueYen options to attract more investors and ordinary users.

- DAI is a cryptocurrency whose exchange rate is also pegged to the dollar. The peculiarity is that tokens are created at the request of the buyer and burned when the user returns the coins to the platform in exchange for Ethereum. The market capitalization is approximately $38 million.

It`s worth choosing cryptocurrencies based on your capabilities and needs because each option has certain pros and cons. For example, some tokens are very liquid but have issues with centralization (as USDT). Other options are quite decentralized, but their rate fell below $0.8 (UST) which scares off users.

Do you have anything to add? please drop a comment or email us with any queries

No Comment