Table of Contents

NoorTrades (noortrades.com) is a registered brand of Paxton Trading Limited. The former is an offshore regulated platform that limits withdrawals. It doesn’t come as a surprise as Noor Trades also behaves in the same manner. And this is the reason why we have to expose the platform. If members can’t entirely withdraw, it doesn’t make sense to invest and trade with the platform. Here’s our clear NOORTRADES REVIEW.

A Closer Look at NoorTrades

Even NoorTrades website is similar to that of Paxton Trade. And the two sister entities share one thing in common; lack of adherence to rules. As a result, you won’t get a chance to profit from your trading fully.

And this poses a considerable problem to investors. A platform that fails to offer withdrawal means it might soon transform into an exit scam. We have seen this happen countless times before. It’s time to eliminate the problem.

Noor Trades acts as a broker who is aligned with the FSC. An offshore-regulated platform offers several disadvantages to investors. What this means is that we could be dealing with a platform knowingly blocking withdrawals.

In an attempt to keep members trading, the platform only allows partial withdrawals of 10 percent. So if you deposit $5,000, the platform will likely let a withdrawal of $500. And this is a huge issue for investors.

A trading platform should give investors a chance to cash out at every opportunity. That’s what makes investing and trading exciting. Limiting the users withdrawal is paramount to fraud. So why would noortrades.com want to keep your funds?

It would be best if you were extra careful when selecting an investment and trading platform. One way is by choosing platforms that have what it takes to offer relative trading conditions. Also, make sure you first find out the experience of others before signing up.

Accounts NoorTrades

Noor Trades offers three accounts, with one being a demo account. The two investing and trading accounts include standard and pro. Most of these accounts share the same features, such as trading tools and pairs.

Let’s take a closer look at each of the accounts;

Demo

We have to give the platform props for availing of a demo account. The demo account is free and offers investors virtual currency of up to $100,000. With the demo account, you get to test your trading skills.

Standard

It’s the most basic account, with investors having to deposit $1000. The minimum deposit is higher than the industry-recommended amount of $250. And this is why you need to learn the rules of trading.

Pro

For the pro account, the platform insists on a minimum deposit of $25,000. Despite the high depository requirement, there are no advantages. The features are the same as those of the standard account.

Account Opening Procedure

Opening an account with noortrades.com is easy. First, you get to fill in the usual form that includes address, contact, and full names. Once you sign up, the platform sends a verification email. After that, you need to fund the accounts to proceed.

A huge red flag that we must point out is that the platform doesn’t verify accounts at first. Instead, the platform waits for members to withdraw funds before confirming your account. You have to send vital documents as part of the verification process.

And this is where we find a huge problem with the platform. The verification process requires sending a copy of your ID, bank statements, and credit card information. We don’t see the reason for such staunch actions.

The platform could verify accounts using normal channels such as emails and phone verification. These authentication channels are used by platforms all over the world. We fear noortrades.com is harvesting banking data from members.

Are funds safe with NoorTrades?

Your funds are far from safe with a platform that fails to offer insurance cover. The platform is registered by a regulator who’s not keen on insurance cover. And this means any amount you deposit does not have insurance cover.

We also suspect the platform is not segregating accounts as dictated by law. Noortrades.com is storing funds in a single account. And this is the reason why you need to stay away from the platform.

Without any insurance cover, the platform can wind up and fail to compensate investors. That’s why we fear NoorTrades is another exit scam. Avoid such platforms that hide or avoid offering insurance cover.

Assets and Financial instruments found

You get to trade with five major classes of trading assets. These include commodities, crypto, forex, indices, and stocks. When dealing with commodities, the platform lists the maximum leverage at 1:100.

With crypto being a volatile market, it makes sense to trade with such a platform. And this means having to trade crypto with leading pairs. The platform avails Bitcoin, Ethereum, Litecoin, and Ripple.

Forex trading is at the core of the platform. You get to trade major and minor currency pairs. There are no exotic pairs which mean investors won’t get the chance to spread their risks. The leverage on forex assets is set at 1:100.

To trade international markets, the platform avails several indices. These include DAX, Dow Jones, NASDAQ, NYSE, and more. Unfortunately, the leverage on these indices is 1:500 and more. And this puts your funds at risk as high leverage means a higher chance of losing.

Stocks are also an integral part of investing. And this is why the platform offers the FAANG group stocks, among others. In addition, you get to trade stocks from leading international companies. That’s what it means to trade in the stock exchange.

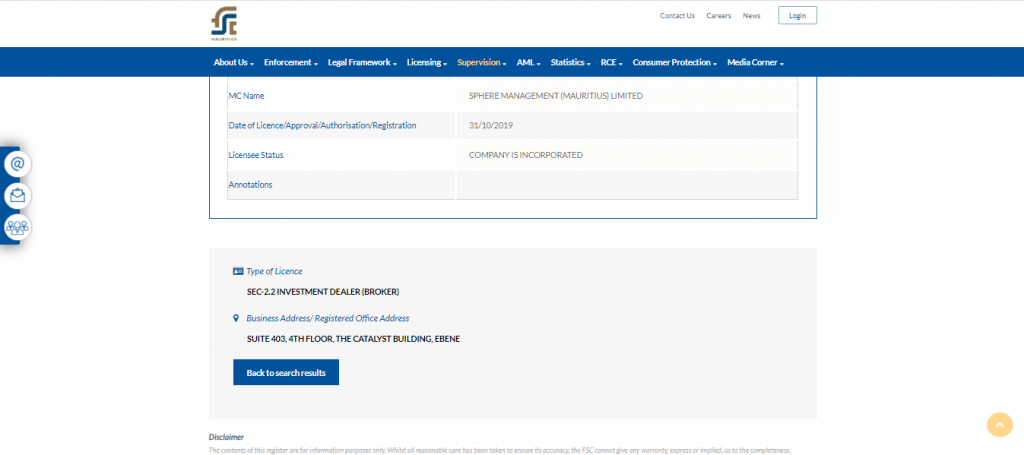

Business owner

Although Paxton Trade Ltd is listed as the owner of the platform, it’s a proxy. The company that registers all these platforms is known as Sphere management Limited. It goes for registration in Mauritius for apparent reasons.

Such entities wouldn’t pass the vigorous regulations in other jurisdictions. And this is the reason the platform goes for offshore registration and regulation. So, all in all, there’s no information regarding the owners of any of the companies.

It makes Noor Trades an anonymous investment platform. When it comes to online investing, you should stay away from anonymous platforms. There’s no security as the platform can shut down at any given time.

Contact and customer support

There are several factors you need to consider when choosing your preferred trading platform. And this means checking how fast their support is to clients. Without fast support, you end up losing faith in the platform.

Sadly, it’s the case with Noor Trades, as there’s no direct access to support. What you get is a platform that fails to offer users any chance of contacting support. An open platform will avail more natural means such as live support.

Funding Methods

You can fund your accounts using bank, crypto, and wire transfers. The platform ensures no one gets an excuse as to why they can’t deposit. In addition, those who deposit funds get to see the funds 24 to 48 hours, depending on the funding method.

We don’t recommend anyone to fund the account. Withdrawing is the biggest obstacle as the platform limits the amount. Investors and traders should invest with platforms that allow easy and fast withdrawals.

Platform

Despite offering a world-class trading platform, even expert traders won’t get to withdraw funds. So when you get to trade with a legit platform, start using MT4, MT5, and SIRIX platforms.

Verdict

Stay away from offshore-regulated platforms that limit withdrawals.

Join our growing community for more on crypto, forex, and investing in general.

If you have any queries, drop a comment or write to us.

Fuscher

Scam platform don’t trust them they logged me out and disabled it until I came across CryptoChargeBack that assisted me to recover my lost funds reach out to them via website and get help

http://Www.cryptochargeback.org

Fuscher

They ripped me off thanks to crypto charge back that assisted me to recover my lost funds reach out to them via website

http://Www.cryptochargeback.org