Table of Contents

SoFxTradet (sofxtradet.com) is claiming to be regulated by CySEC, which is far from the truth. The platform has, over the last seen months, seen an influx in complaints. We have to dig deeper to find the root cause of the problem. So FX Tradet is an anonymous platform taking advantage of naïve investors. We have the reasons why you must stay away from the platform. Learn more in our exclusive SOFXTRADET REVIEW.

A Summary of SoFxTradet

On their about us page, the platform claims to be innovative and transparent. The goal is to provide secure and simple online trading activities. You also get the claim it’s one of the leading binary and CFDs online providers.

SoFxTradet will do or say anything to get investors to sign up with the platform. And this is the reason why we must expose the platform at all costs. So you need to know the truth before signing up with sofxtradet.com.

Members have been complaining of withdrawal delays for the past few weeks. Only a handful of members get to withdraw partial amounts. Those that do are closely affiliated with the platform for one reason or the other.

We believe the platform is using them to make proof that withdrawal is possible. Normal investors who have no ties with SoFX Tradet don’t get to withdraw funds. It’s unfair, and it’s the reason why we must expose the platform.

Blocking withdrawals from members who have already made winning trades is unimaginable. We don’t get why the platform would want to go that route. The only way the platform does that is if it plans to wind up.

And this makes so FX Tradet an exit platform ready to steal from members. CySEC has been made aware and plans to issue a warning. It would be best if you did thorough research before investing funds with such a platform.

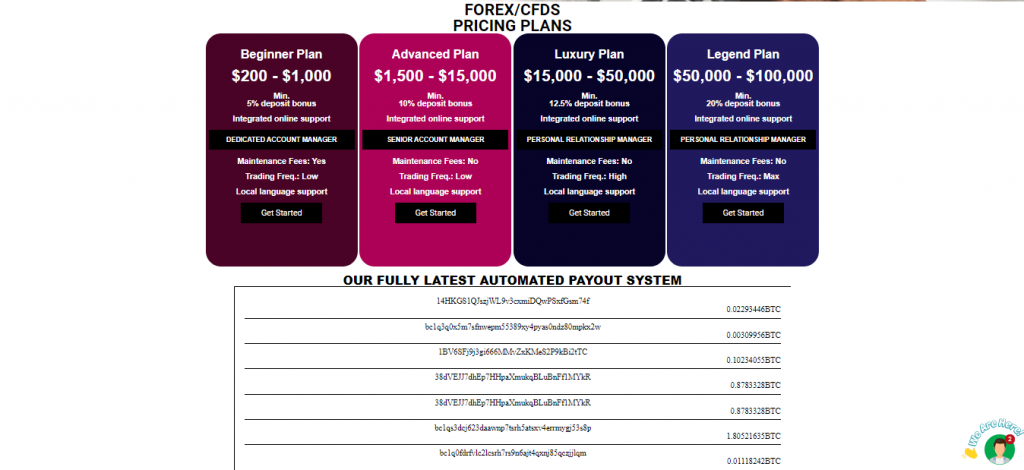

Accounts and Investment Plans SoFxTradet

SoFxTradet offers investors four investment plans, each with a different set of features. What’s clear with all these accounts is that the platform promises a discount with each deposit. The four accounts include beginner, advanced, luxury, and legend.

Here’s a closer look at each of the four accounts;

Beginner

The account is best for newbies and comes with a minimum deposit of $200 to $1,000. There’s a 5 percent deposit bonus with the platform promising online support. Unfortunately, we couldn’t see any account trading features.

Advanced

For the advanced plan, investors have to deposit $1,500 to $1,500 to start trading. After that, you get a 10 percent bonus deposit with the platform. In addition, there is no maintenance fee with the platform promising a senior account manager.

Luxury

With the luxury plan, you must deposit $15,000 to $50,000. In addition, there’s a 12.5 welcome deposit with the platform availing a personal relationship manager. However, we don’t see the reason for having a personal relationship manager with a trading account.

Legend

It’s the most exclusive account which mainly targets institutional and wealthy clients. There’s a minimum deposit of $50,000 and $100,000. In addition, members get a 20 percent deposit bonus and a personal relationship manager.

Account Features

As far as trading goes, the platform fails to inform users of necessary trading information. And this means investors are signing up blindly, not knowing the available features. In addition, members are joining not knowing the leverage for trading assets.

The industry has set 1:100 as the maximum possible leverage. In the United States, the regulator sets 1:50 as the maximum leverage for retail traders. Investors don’t even know the type of spreads available on the platform.

Account Managers

These relationship managers are mere call agents who talk you into depositing more funds. The platform uses them to entice users to deposit more funds into other accounts. You will usually get a call from them with claims of having a lucrative investment option.

Avoid picking their calls as there’s no chance of ever getting back funds after depositing with them. The platform will move quickly to replace the account manager with a new one. With that, there’s no way of recovering your funds.

Assets and Financial Instruments available on the platform

You get to trade with five trading instruments: commodities, crypto, forex, indices, and stocks. Most of the commodities you find include cocoa, coffee, wheat, and more. The platform also avails commodities from the manufacturing sector.

With crypto quickly becoming one of the most sort after assets, it makes sense to trade with it. The platform offers leading crypto assets paired with major currencies. You get to trade Bitcoin, Dogecoin, Ethereum, and Litecoin.

Forex trading happens to be at the core of the platform. Members get to trade with exotic, major, and minor pairs. Without leverage information, we recommend putting leverage at a maximum of 1:50.

The platform also makes it possible for investors to trade with leading indices. These include Dow Jones, NASDAQ, NYSE, and more. Trading with indices helps you get a better understanding of the world’s markets.

With stock trading, you get to own a piece of leading companies shares for a time. And this is why the platform offers stocks from the FAANG group. These are some of the leading and most sort-after stocks in the market.

Business holder

B.O Tradefinancials Ltd is the entity we are told owns the platform. You should know that scam artist will even use details of already registered platforms. Investors can always ask and find out from the parent company whether its affiliates with the platform.

What we have is a classic example of a platform trying to get approval from investors. SoFxTradet is an anonymous investment platform that we should all avoid. The platform has no way of proving its existence on any registration document.

Contact and customer support

You should check out each platform and try and find out whether the platform is legit. Then, go for platforms that try and offer more direct access to support. That’s what’s missing with So FX Tradet.

There’s no way of accessing support which is a nightmare. The platform ought to offer investors a more valid way of support. There’s a phone number listed which doesn’t seem to work. It’s proof the platform wants to control the communication channels.

Funding Methods

The platform offers bank and wire transfers for funding accounts. Your balance will reflect in your account within 24 hours, depending on the method. We don’t recommend funding these accounts for security reasons.

Since withdrawal is a problem, there’s no need to fund an account with no way of earning profit. The platform is waiting for you to deposit and run away with your funds. Avoid it or else become their next victim.

Is SoFxTradet Licensed or Regulated?

SoFxTradet is not a licensed or regulated platform. And this means your funds are far from safe. The platform does not have any license from CySEC despite claiming so on their homepage. If it were true, the regulator would have a record of it.

Stay away from unregulated platforms as there’s huge financial risk. The platform won’t bother offering investors over the moon profit claims to get them to deposit. You now know the risks that come with investing with sofxtradet.com.

Our Verdict

SoFxTradet is a clone platform putting your funds at risk. So please stay away from it.

Feel free to join our growing community for information on crypto, forex, and online investing.

No Comment