Table of Contents

Crypto futures trading is a recent phenomenon that emerged when the Chicago Mercantile Exchange (CME) introduced Bitcoin Futures trading in December 2017. This type of trading involves the ownership of a contract based on a particular crypto asset, like Bitcoin, instead of owning the actual asset itself. In this case, the exchange takes care of the storage and transfer of the underlying asset while the investor or trader holds a Futures contract for the cryptocurrency. For more information you can visit Bitcoin Prime platform .

Lately, Cryptocurrency Futures have gained popularity among traders and investors as a convenient way to invest in crypto without the hassle of buying and storing assets. In addition to offering a simple investment process, Crypto Futures address problems associated with locating liquid marketplaces when seeking to sell assets. The crypto futures markets offer high liquidity to their traders, providing them with the option to buy and sell digital currencies quickly, thus cutting down on slippage rates and increasing trading effectiveness. This, alongside the unstable nature of digital assets, enables traders to speculate on the market and make profits from the volatility it presents.

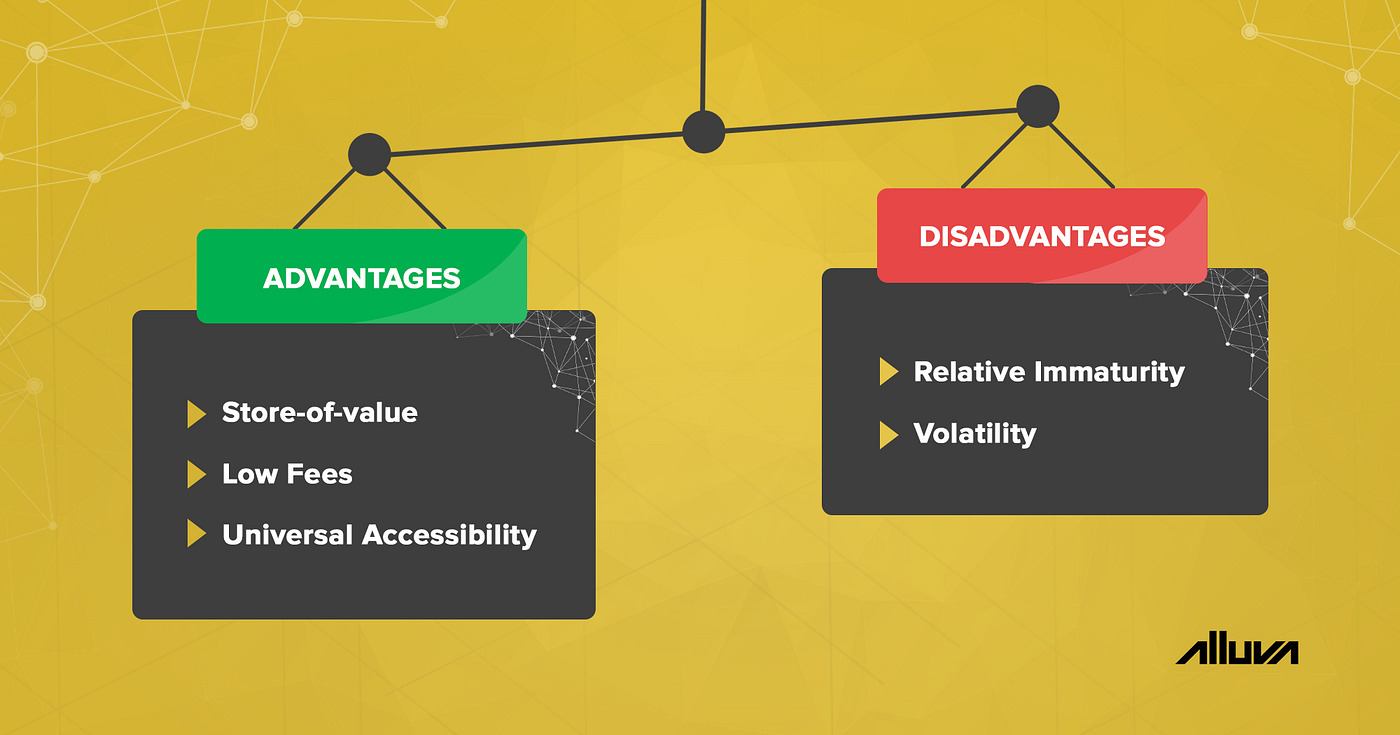

What are the advantages of Crypto Futures?

- Leverage: Crypto futures have one thing distinctive, leverage, which is truly awesome. Leverage implies that even though you do not have lots of money, you can still have the ability to manage the value of a big contract like Bitcoin. It enables you to make huge trades using minimal capital.

- Flexibility: The flexibility in trading provided by crypto Futures contracts is one factor which makes them appealing to traders. Among the easiest instances would be that in case an investor in the crypto Futures industry thinks the valuation of that cryptocurrency is likely to drop soon, they can just go short on that asset. In the case of spot trading, or maybe margin trading, this might not have been very easy and simple. This particular flexibility also lets traders carry out scalping methods on the industry, and that is not always extremely effective or even powerful when it involves the spot market.

- Hedging Tool: Long-term investors also can make use of crypto Futures to restrict their downside danger by taking an opposite place from their investments in the Futures marketplace. In this manner, making use of these Futures contracts, the short-term downside risk is lessened and also you could make an income from it.

- Convenient and Simple: The ease of crypto futures trading is one of the biggest benefits. It lets you speculate on the selling price moves of crypto property as well as make money from them, without needing to keep or even possess the crypto assets themselves.

What are the disadvantages of Crypto Futures?

- Ownership: Crypto Futures owners that take part and then purchase crypto assets can not benefit from the financial advantages of voting and stake, because there’s zero ownership of the fundamental crypto. Additionally, this is something which could be thought to be a disadvantage.

- Leverage: Use is among the most significant advantages of crypto Futures contracts, though it may additionally be considered a big disadvantage. The marketplace may be susceptible to this and new traders may overleverage the industry, which may lead to an entire loss of money in case the swap moves against them and they’re liquidated by the exchange.

- Lack of Regulations: The marketplace for crypto futures remains fairly young and changing. When compared with conventional markets, it works with limited regulatory supervision. Insufficient regulation could expose traders to possible cheating, market manipulation along with other risks.

- Technical Complexity: It’s essential to have some specialized expertise to market crypto futures. It may take a short while to understand the cryptocurrency industry, and this is helpful in case you’re just getting started.

Find out the Top most profitable ASIC Miner today!

Comments are off this post!