Reserve Rights Token

(rsr)

Not AvailablePrices are in USD.

Market Data For Reserve Rights Token

| Current Price | $0.0077 |

| Market Cap | $286,260,640 |

| Market Cap Rank | #229 |

| Total Volume | $24,341,946 |

| High 24H | $0.0057 |

| Low 24H | $0.0052 |

| Price Change 24H | 0.00% |

| Price Change Percentage 24H | 7.97% |

| Market Cap Change 24H | $20,647,050.00 |

| Market Cap Change Percentage 24H | 7.77% |

| Circulating Supply | 50,600,001,536 rsr |

| Total Supply | 99,999,997,952 |

| All Time High |

$0.12

-95.18%

April 16, 2021 |

| All Time Low |

$0.0012

March 16, 2020 - |

Coin Data For Reserve Rights Token

About Reserve Rights Token

Reserve Rights Review: Mining Guide, Price & amp; Analysis of the Reserve Rights Cryptocurrency

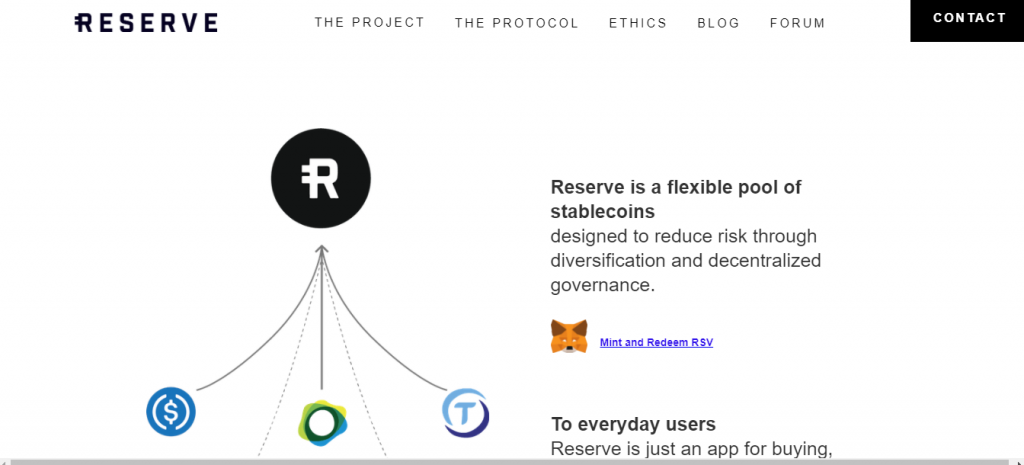

Reserve Rights is a cryptocurrency designed for countries with inflation problems. The developers of this blockchain believe they have the solution to high inflation. It operates on a dual token model that is unique from other blockchains.

Currently, governments and central institutions have full control of reserves and value control. The problem is that such players do not know how to keep currency value stable. This leads to an economic crisis, like what is happening in Venezuela. This is the case with many other countries.

Reserve Rights steps in to help such countries keep inflation rates low. This dramatically helps countries stabilize and elevate their economies. Moreover, it frees users from the control of central institutions. They control their own assets and the development of this blockchain. Further, this blockchain has high accessibility.

This blockchain provides users with a stablecoin. Hence, it is competing with some of the best cryptocurrencies in the market. These include the likes of Tether and Paxos. The developers have a lot of work to do to catch up with these projects.

How Reserve Rights Works

Reserve Rights has an initial centralized phase. However, this is part of the plan. The developers only do this until the project gains more popularity and adoption. At that stage, the developers will leave the project in the hands of the community.

In the centralized phase, a small number of tokens act as collateral to back the RSV stablecoin. In turn, the US dollar backs each of these coins. Hence, the price of RSV stays stable due to the price of pegged stablecoins.

The project also has a decentralized phase. Here, a number of changing assets back the RSV token. The only conditions that these assets have to keep the price of RSV stable. The goal is to keep the price at one dollar.

In the independent phase, the RSV token will no longer need the price of the dollar to stay stable. It will be independent. The goal here is to keep the purchasing power of the token stable. Therefore, the value will stay the same no matter whether the value of the US dollar fluctuates.

Can Investor Mine on the Reserve Rights Network?

No, it is not possible to mine on this blockchain. It is still new, and the developers have not finalized everything. Currently, there is no specified consensus that they are going to use. This is subject to change. The developers may make changes as they see fit with time.

However, this project currently runs on the Ethereum blockchain. Therefore, it depends on Ethereum’s Proof of Work to secure the network. This is only for security, and there is no rewards system in place yet.

The Team behind Reserve Rights

Reserve Rights boasts one of the best teams in the cryptocurrency space. The founders of this project are Nevin Freeman and Matt Elder. Nevin serves as the CEO and Matt as the CTO. Nevin has excellent experience in leading the development and evolution of projects. He is a serial entrepreneur who co-founded three companies.

On the other hand, Matt has experience in technology and development. Previously, he worked as an engineer at Google, IBM, and Quixey. His graduate thesis for the University of Wisconsin was in program analysis.

This is a great leadership team for any blockchain solution. Therefore, it is safe to say that this project is in safe hands. Moreover, there are other members of the team who are equally experienced.

Further, the company has great partners and funders. Some key investors include the exchange Coinbase and Peter Thiel. Peter Theil is a co-founder of PayPal, Palantir, and Founders Fund. It is great to see that they have faith in the project.

The Dual Tokens System

The Reserve Rights network uses two primary tokens. These include the RSV and the RSR token. The RSV token is the stablecoin in this system. The use of the RSR token is to stabilize the price of the RSV token. It ensures that the price stays at one dollar per token. Arbitrage opportunities in the ecosystem help keep the price of RSV stable. Moreover, the company can control the supply of RSR tokens depending on the price demands of RSV.

In any case, these two coins have different market caps in the market. Additionally, they have different adoption rates. The RSR token has a significantly better market cap and adoption. Its price is volatile. Hence, people can make profits from it.

Privacy and Security

Reserve Rights has excellent security features. It runs on the Ethereum blockchain. This is one of the most secure blockchains in existence. Additionally, Ethereum uses the Proof of Work consensus. This is a very reliable security measure.

The only problem with this consensus is its nothing at stake nature. It opens the network to the possibility of 51% attacks and double spends. However, Ethereum continues to prove that it is reliable in terms of security.

Moreover, this is a blockchain project. This means that it consists of distributed nodes that work together to secure it. Each node contributes computational power to help in security. Hence, an outsider would require very high computing power to break into the network. Furthermore, there is no central database to attack.

In terms of privacy, this blockchain operates transparently. The public ledger keeps a record of all transactions on the blockchain. However, these records are immutable and safe from attackers.

Or Take on Reserve Rights

This blockchain project has a very valid mission behind it. Its success would help so many countries stabilize their economies. This is a great way to free a country from the hands of politicians. Moreover, it helps countries with inflation catch up with other countries.

The only thing that this project is missing is better adoption. The only token in mass circulation is the volatile RSR token. This is because investors can make profits off it. The developers need to get more people and countries on board.

Advantages

- It helps stabilize the economy of countries.

- It is fast and secure.

- Reserve Rights tokens are easily accessible.

Disadvantages

- The stablecoin on this blockchain still does not have enough adoption.

How to Buy and Store Reserve Rights Tokens

If you like what you see with Reserve Rights, then you can buy its tokens. Some of the best exchanges to use include Poloniex, Binance, Huobi Global, and HBTC. The current price of one RSR token is $0.036954. The price of the RSV token is always one dollar.

You will need a crypto wallet to store your tokens once you purchase them. Some of the best wallets to use here include Ledger, Coinomi, Exodus, and MetaMask.

Final Verdict

It is easy to get behind the mission of this cryptocurrency. It is already in use in a country like Venezuela. Here, it is helping stabilize the economy. It has excellent potential for growth. The developers only need to convince more people to onboard and use this cryptocurrency.

In any case, the stablecoin does not have enough adoption. But, the volatile token is seeing great success in the markets. It currently ranks in the top 100 in market cap share.

$97,172.00

$97,172.00

$3,109.04

$3,109.04

$1,528.07

$1,528.07

$2,389.10

$2,389.10

$609.61

$609.61

$516.49

$516.49

$294.43

$294.43

$161.98

$161.98

$88.85

$88.85

$157.97

$157.97

$86.66

$86.66

$74.47

$74.47

$76.21

$76.21