Table of Contents

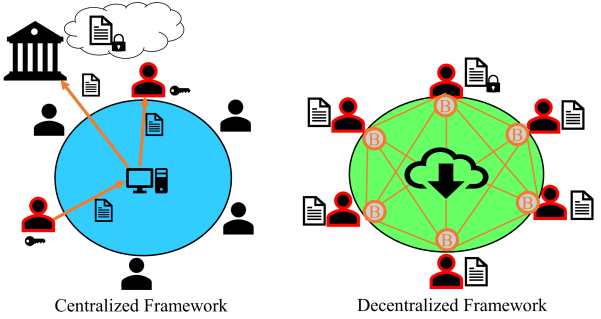

Due to the extensive availability of digital tokens like bitcoin, almost everyone has a hold of these digital investments. You will find it more people have an investment in the bitcoin while others find it feasible to invest in multiple digital tokens. Regardless of what cryptocurrency you are investing, you might have always tried to invest in bitcoin on the sites like bitcointrader2.com . The nature of everyone is the same because bitcoin is delivering considerable benefits to the people, and therefore, you would like to invest in it. But, before doing so, you should know about the centralized and decentralized frameworks in bitcoin. Yes, today, if the government is willing to accept bitcoin legally, it may work on this centralized mechanism of bitcoin trading.

On the other hand, if the government does not want to support the ecosystem of bitcoin, It will always remain a decentralized medium of making money for everyone. So, these are a few specific things about bitcoin that can become its possible future. Therefore, anyone willing to trade in the bitcoin or use it must clearly understand it. It is because, with the knowledge of both aspects, you will not be shaken by any action taken by the government. On the contrary, you will be well prepared for the same in advance; therefore, getting accurate information about it is crucial. Furthermore, you should know how cryptocurrencies will become in the future if they are centralized or remain decentralized. With a clear understanding of these concepts and distinctions, it will be easier for you to handle both situations.

PS: Want to start mining cryptocurrency? Check out the ASIC profitability.

Centralized trade

First, we will be heading down the crucial details regarding the centralized trade mechanism of bitcoin. This scenario is only going to come true if bitcoin is accepted legally across the world. In a country like El Salvador, bitcoin has become legal, and centralized trading can also occur in the future. This is where the following situations will appear, which will be the features of trading in the case.

- You are going to pay a certain amount of tax to the government whenever you are going to make a profit out of your cryptocurrency trading. So, for example, if you are trading in the bitcoin and making almost one lakh dollars every year, perhaps 10 to 20% of that profit will be paid to the government.

- Whenever you do any illegal activity with the help of cryptocurrencies, the government will know about it very clearly. Also, tracing the transaction will be more accessible and more sophisticated if it is centralized. So, the trade mechanism of bitcoin becoming centralized will be very good for some situations like money laundering and illegal activities.

These two are the scenarios that are going to occur if the cryptocurrency trade mechanism is centralized. However, this is no near future as the government’s criticism of bitcoins and other digital tokens.

Decentralized trade

The mechanism you see today with cryptocurrency trading is decentralized; therefore, there is no central authority over the prices or regulations. However, a few of the details of this mechanism are given below.

- You might have seen that the government is not enthusiastic about the bitcoin; therefore, you cannot legally trade in it. So even though in some nations, you do not have any ban on bitcoin, you are consistently not being supported by the government.

- Whenever a transaction is made with the bitcoin, the transaction is traceable to the origin. It is because no top authority is available to regulate the cryptocurrency transaction, making it challenging to trace the transaction’s origin in any situation.

- Security standards are available from private firms, but no government support exists. The government will not provide you with any help regarding the safety and security of digital tokens. However, once your digital tokens are stolen, the government may intervene and provide you with legal action.

- There is no regulation on the prices of bitcoin from the government. As there is no central authority, no one has the power to regulate the prices, and it keeps on being circulated on the price and demand mechanism.

It is believed that if cryptocurrencies always remain decentralized, they can survive. However, if the government decides to make them legal and they become centralized, there will be a downfall in their demand, and people will lose interest in them. Therefore, the decentralized mechanism of trade is more favorable for bitcoin.

Feel free to drop a comment or join the crypto conversation.

No Comment