Table of Contents

Coinrise (coinrise.ca) is a crypto investment clone platform trying to take advantage of naïve investors. The platform doesn’t reside in Canada, and we believe it’s an offshore-led platform. Those who have invested with the platform are ruing the decision. The platform is without doubt withholding funds from members. No one has made any successful investment, and we must expose it. Get to learn more in our comprehensive COINRISE REVIEW.

A Clear Summary of Coinrise

According to the word of the founder, Coinrise is here to prove them wrong. Unfortunately, information about the founder is scanty at best. We have to expose the platform for its blatant disregard of investors and the industry as a whole.

Those who signed up were enticed with the high-profit claims the platform promised. With instant withdrawal promises, most believed it. After depositing funds, the account balance would grow within a night.

When the time came to withdraw funds, that’s when the platform revealed its true colors. But, unfortunately, no investor has managed to withdraw funds from the platform. So we have to expose the platform and help other investors from falling into the same trap.

You should invest in quality investment platforms with a proven track record. Then, go for innovative investment options such as Coin staking, DeFi, and Masternoding. It’s the only way to ensure you earn realistic ROI.

The services the platform claims to offer include guided accounts and market updates. You get a promise of using advanced trading techniques thanks to the platform’s capabilities. Unfortunately, no one gets to see how the tech works.

Your priority as an investor is to find out the platform’s accuracy and legitimacy. One way of doing that is to read our transparent reviews on crypto and forex products. Get to know what others are saying about a platform before committing funds.

Accounts Coinrise

Coinrise offers six account types for the taking. The six include Mini, Silver, Gold, Platinum, Diamond, and VIP. Each of the account tiers comes with a different feature to attract different classes of investors.

Let’s take a closer look at these accounts;

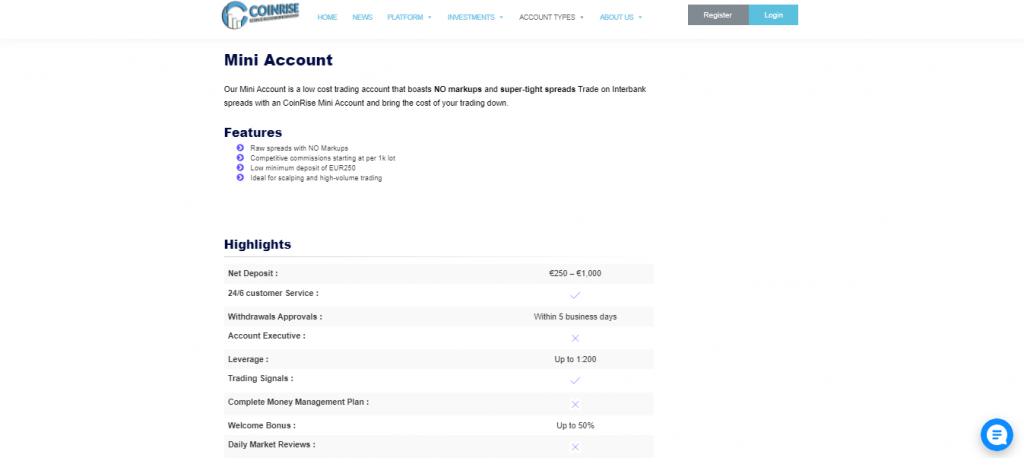

Mini

For the mini account, the platform guarantees it’s a low-cost trading account. Leverage for this account is set at 1:200. The minimum acceptable deposit is set at 250 to 1,000 Euros. There’s also a welcome bonus of 50 percent of your deposit.

Silver

With the silver account, leverage is also set at 1:200. Members must deposit 1,001 to 5,000 Euros. There are no mark-ups or super-tight spreads with this account. The only difference with the mini account is the deposit requirement.

Gold

Gold account holders also share the same leverage as the two accounts above. In addition, members get one weekly managed session with a professional. There’s also a welcome bonus of 60 percent. You need to deposit 5,001 to 25,000 with this account.

Platinum

There’s leverage of 1:300 for the platinum account holder. Withdrawal approval is set within three days, with the account having a welcome bonus of 70 percent. There’s a minimum acceptable deposit of 25,001 to 100,000 euros.

Diamond

With the diamond account, you must make a minimum of 100,001 and a maximum of 250,000 Euros. In addition, members get a welcome bonus amount of 80 percent. Withdrawal approvals are slated within a day of request.

VIP

It’s the most premium account type. The leverage is high and set at 1:1000. Members get a welcome bonus of 100 percent. That means the platform will match your deposit. The allowed deposit is set at 250,000 euros and above.

Account Features

We have to state the obvious, the high leverage that comes with these accounts. Members who trade crypto with these accounts are bound to make losing trades. With the crypto market being volatile, this is a guarantee.

High leverage means you will lose more when you make a losing trade. Industry regulators have moved in to protect investors from high leverage. There’s a cap on such leverage set by regulators in different jurisdictions.

In the United States, CFTC sets a lid on leverage at 1:50 for retail traders. Other regulators set the terms on maximum leverage at 1:100. It would be best if you remembered that such platforms profit when members make losses.

Account Managers

You also get to get an account manager for the more advanced account types. The problem with these managers is that they solicit funds from investors. So instead of offering advice, these managers will come up with lame investing options.

Members get calls to invest in a lucrative deal that lapses shortly. When you decide to invest with them, the calls suddenly go silent. Asking to contact the manager via support is not helpful. The platform will quickly move to replace the account manager.

And that’s how you will lose another chunk of your funds with these managers. Despite their tag, no one knows their professional or skill levels. And this is why we must expose the platform.

Bonuses on offer

Be extra careful with platforms that claim to match your deposit. Even regulators have warned investors from investing with such platforms. An excellent example is the bloated 70 to 100 percent welcome bonus.

You have to ask yourself, where does the platform get the funds to offer such bonuses? The truth is, the platform simply manipulates your account balance amount. So you think you get extra funds, but in reality, it’s false information.

Members won’t get to withdraw funds unless they pay back the full bonus amount. And when they do, the platform moves quickly to block access to these accounts. So you will have lost double the amount within a short period.

Business Proprietor

Joel Alexander is the name we are told owns and runs the platform. However, we know for a fact that coinrise.ca is a clone. The platform is using the name of Coinrise Group.

CA Mohit Taneja is the real owner of the legit business CoinRise. Joel is an imposter who wants to take advantage of naïve investors. We are sure that the real platform doesn’t know there’s a clone of its name.

Coinrise License and Registration

Coinrise is not a licensed or registered entity. We don’t have any regulator in the world that would stand for such high leverage. Instead, authorities in Canada and the UK want to raise the alarm after investigations are complete.

Make sure to check whether a platform is licensed or registered. Confirm with regulatory bodies such as ASIC, BaFIN, CFTC, CONSOB, CNMV, CySEC, and the FCA. These bodies guarantee safety for all investors.

Contact and support

Another reason to doubt the platform is the contact aspect of it. There’s a chat tab that claims replies come in a few hours. No one has time to wait for a response that long. When you take a look at the contact page, you get two email addresses.

There’s a Google map that shows the platform’s headquarters in Canada. And yet, the contact email has a UK domain name. These are the mistakes the platform makes in an attempt to hide its true identity.

Fund safety with Coinrise

Your funds are far from safe with a platform that fails to provide investors with insurance cover. Funds don’t get insurance cover with this platform.

Our verdict

Please stay away from Coinrise as it’s a clone.

You should invest wisely in proven entities. Go for coin staking, DeFi, and Masternoding. It’s a proven way of investing safely.

Feel free to join our growing crypto community for more.

Earl BURROWS

Coinrise: an absolute scammer. All withdrawal attetshave fallen onn deaf ears. Avoid these crooks at all cost.

Earl BURROWS

Coinrise: an absolute scammer. All withdrawal attempts have fallen on deaf ears. Avoid these crooks at all cost.

Kym Pfannmuller

Definitely crooks. advisors try to talk you in to making large deposits for a large return. If you fail to cooperate, they dump you. I had three advisors all using the same style. After a while they gave up on me. Now I have no one to contact because the advisors won’t answer my emails or calls. the site does not provide real contact information, it’s all fake.

Henry

Yes, we had to expose them and protect others from falling into the same trap.

Reuben Garner

thanks for the referral, i got my funds back.