Table of Contents

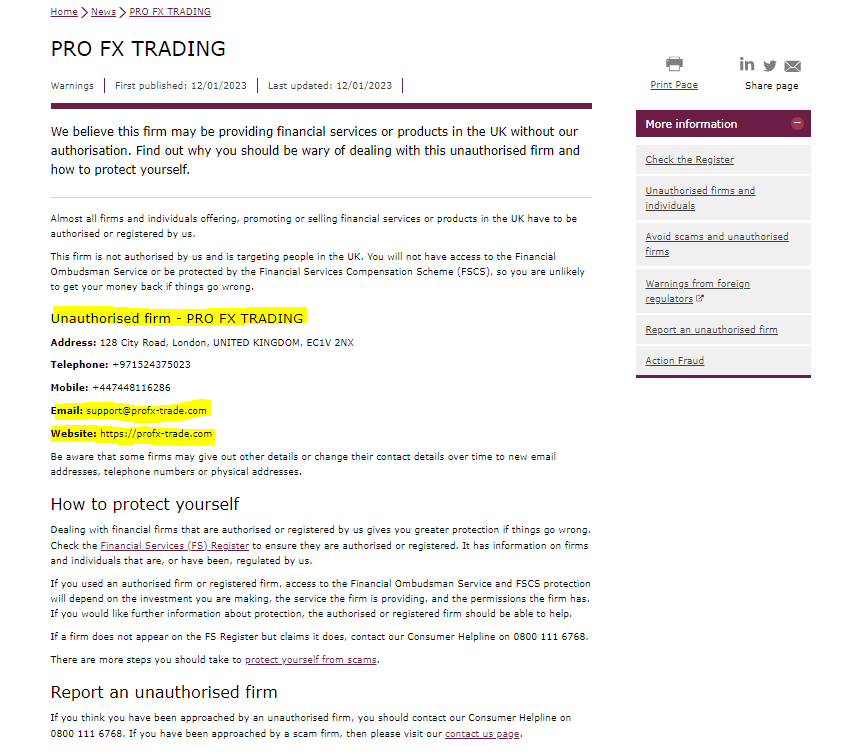

ProFX-Trade is another scam listed by the Financial Conduct Authority as unauthorized.

Those who have invested with the broker are now crying foul after the broker blocked withdrawals.

With complaints reaching the FCA, the warning was immediately issued, and the broker is now a known scam.

QUICK READ: What is the best way to earn high ROI without much risk? You need to invest in proven and tested tools.

ProFX-Trade is a platform that doesn’t have what it takes to offer fair trading conditions. Worse news is no member gets to withdraw funds from the platform.

And that’s where we draw the line with such brokers. Even an unregulated broker should allow members to trade and withdraw funds.

That’s not the case, as our profx-trade.com review will reveal. It’s not all rosy, and the broker will likely close the shop soon.

How do you avoid such brokers?

Our Pro FX Trading review exposes the red flags that indicate the broker is a scam. You need to watch out for such antics from any broker.

Before engaging with a broker, we recommend doing due diligence. Try and find out what makes a platform tick.

Check out the conditions available before committing any funds.

About ProFX-Trade

On the about us page, the broker boasts of being a renowned ECN/STP brokerage founded in 2018.

Domain records show the website is barely a year old which points out to one of the first lies. The broker won’t deliver much in terms of accountability and transparency.

The core values include competitiveness, a formidable framework, opportunities, and a stable trading platform.

All these are not available as the broker is not in any way offering a fair place for trading. Once you sign up, you give them the power to do as they want with your funds.

And that’s far from exciting when it comes to online trading. You need a broker who offers a liquidity service with world-class trading conditions.

ProFX-Trade on the other hand is a broker failing to offer much when it comes to transparency. What most members don’t know is that the broker will eventually block withdrawals.

And that’s the biggest issue facing anyone who deposits and starts trading with the broker. Truth be told, the broker won’t even respond to withdrawal complaints.

Advantages and cons of ProFx-Trade

There’s no actual advantage when trading with a broker already blacklisted by the Financial Conduct Authority.

What this means is that the broker won’t follow the laid out principles when offering brokerage services.

Before signing up with a broker, you must weigh the pros and cons. That gives you an idea of what the broker has to offer to investors.

One of the best weighs to review a broker is by reading our reviews. You can also do a quick search and see what the community thinks of the broker.

A quick search using search engines reveals a common trend; the broker is also listed as a scam.

And these are reviews and comments from independent sources. It paints a picture of what to expect from the broker.

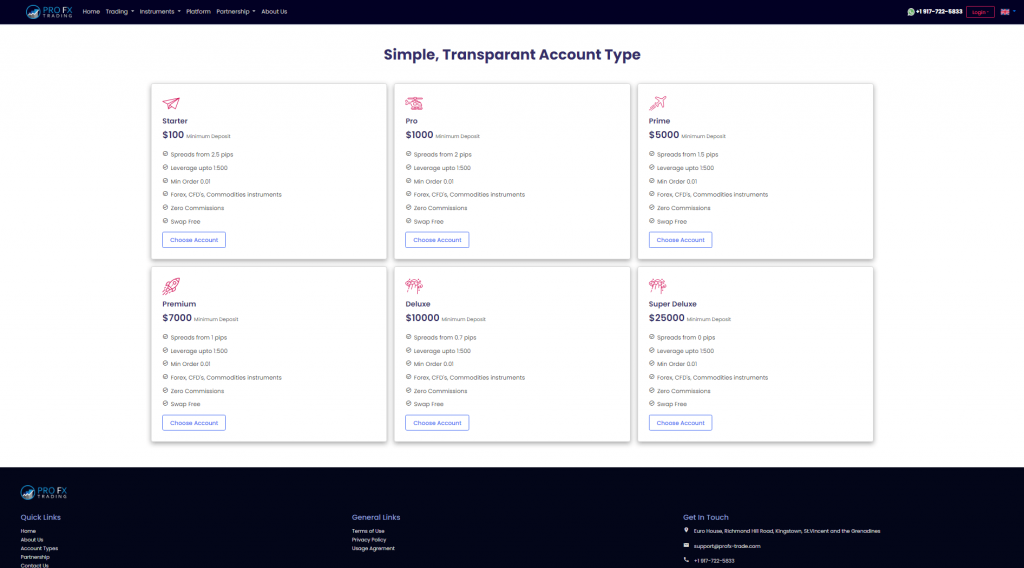

Accounts and plans profx-trade.com

There are six plans to choose from when trading with ProFX-Trade. These include starter, pro, prime, premium, deluxe, and super deluxe.

Here’s a closer look at what each account has to offer

Starter

It’s the most basic plan with investors having to deposit a minimum of $100. Spreads start from 2.5 pips with zero commissions and a swap-free account.

Pro

For the pro account holder, there’s a minimum required deposit of $1,000 to get started. Spreads start from 2 pips with leverage set at 1:500.

Prime

With this account, spreads start from 1.5 pips with members required to deposit a minimum of $5,000.

Premium

There’s a minimum account deposit of $7,000 required to start trading with the premium account. Spreads start from 1 pip.

Deluxe

$10,000 is the minimum acceptable deposit for the deluxe account. Spreads start from 0.7 pips and is one of the top tier plans.

Super Deluxe

It’s the most exclusive account, with investors having to deposit $25,000. Spreads start from 0 pips with no demo account available on all accounts.

Account features

What makes the accounts interesting is the high leverage set which contravenes trading regulations.

Leverage for forex assets should be 1:100 in nearly all jurisdictions. Retail traders in the United States enjoy a much lower leverage of 1:50.

Another issue worth mentioning is the lack of a proper demo account feature. Members, even newbies, are to sign up without testing the features.

A genuine broker will offer a demo account to help traders with the brokerage.

Note: Find out why experts are turning to sports trading as opposed to crypto trading robots.

Affiliate program

There’s a partnership deal the platform offers for anyone willing to direct traders to the platform. With their affiliate program, no one earns commissions.

Instead, the broker promises to boost your trading experience by offering advanced tools and apps.

Compliance, License, and Regulation ProFX-Trade

ProFX-Trade is not a licensed broker and therefore puts your trading position at risk. Those who have invested are now crying foul after the broker blocked withdrawals.

The broker claims to have a valid license from the FSA, with no proof of it. There’s no certificate upload for members to use for verification.

Before you sign up with a broker, ensure the broker has a valid trading license. Check and confirm the broker’s details are found on the registry certificate.

If not, then you have to know the risks that come with an unregulated broker.

Contact, and support from staff

There’s no support from staff coming your way. And that means members are left to answer queries.

Despite leaving a phone number, the broker doesn’t offer much in terms of any direct means of communication.

The lines are ever busy, and there’s no way of getting hold of anyone.

Deposit and withdrawal

Funding your account with the broker is fast, and it takes less than 245 hours for the funds to reflect on your member dashboard.

Withdrawing funds remains the biggest issue facing members of the platform.

Safety of funds with ProFX-Trade

Your safety is not a guarantee when it comes to a broker who doesn’t have a valid license. The broker fails to offer insurance cover for deposits made by clients.

Verdict on profx-trade.com

Please avoid the broker as best as possible.

NB: Here’s how best to invest safely in the markets and earn real ROI.

Do leave a comment or email us with any queries.

No Comment