Binance USD

(busd)

Not AvailablePrices are in USD.

Market Data For Binance USD

| Current Price | $1.00 |

| Market Cap | $85,015,288 |

| Market Cap Rank | #500 |

| Total Volume | $29,792,954 |

| High 24H | $1.02 |

| Low 24H | $0.99 |

| Price Change 24H | 0.00% |

| Price Change Percentage 24H | -0.01% |

| Market Cap Change 24H | $258,036.00 |

| Market Cap Change Percentage 24H | 0.30% |

| Circulating Supply | 84,511,464 busd |

| Total Supply | 84,511,464 |

| All Time High |

$1.15

-13.10%

March 13, 2020 |

| All Time Low |

$0.90

11.30%

May 19, 2021 - |

Coin Data For Binance USD

About Binance USD

Binance USD Review: Mining Guide, Price & Analysis of the Binance USD Cryptocurrency

Binance USD is a stablecoin created by the Binance group. Binance is best known for its world-leading cryptocurrency exchange. The Binance exchange is the best cryptocurrency exchange in terms of the trading volume.

Binance recently decided to expand its ecosystem. One of the newest products in this ecosystem is the Binance USD stablecoin. Stablecoins are cryptocurrencies that do not have volatility in the market. To achieve this, these coins have backing from real-world assets. Binance USD works in the same way. The coin has backing from the US dollar.

BUSD allows users to transfer their money very fast. It is competing with some of the biggest stablecoins in the market. This includes cryptocurrencies like Tether and USD Coin by Coinbase.

Binance partnered with Paxos to launch Binance USD. Paxos is the world’s leader in digitizing and mobilizing physical assets. Additionally, they are behind one of the most successful stablecoins, PAX. Further, they provide the reserves that hold the US dollars needed in this process.

How Binance USD Works

The Binance USD coin has a one to one ratio with the US dollar. This means that one Binance USD coin is equal to one US dollar. The Paxos group holds the US dollars needed in this process in their reserve accounts in a US bank. Users can be sure there is dollar backing since this is a regulated process.

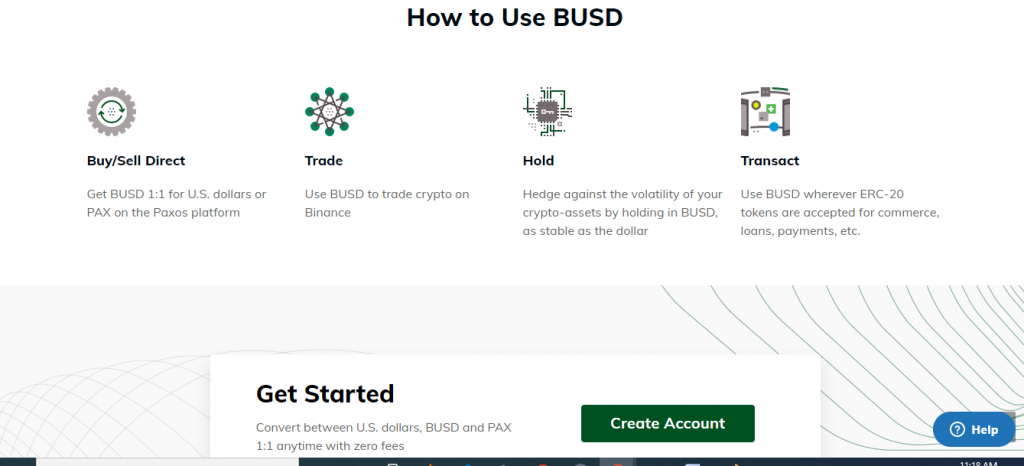

You can access the Binance USD coin as an ERC-20 or BEP-2 coin. This is because both the Binance and the Ethereum blockchains host the transactions of this coin. As such, the transactions involve Ethereum smart contracts. Hence, there is no need for a central institution to process transactions. Moreover, this increases the accessibility of this coin.

Users can redeem the Binance USD coins at any time. They can redeem the coins for an equivalent amount of US dollars. In this case, Paxos will transfer the money to the user’s account. This process is free. The only chargers that apply are bank charges.

Additionally, users can trade this coin for Bitcoins or other crypto assets. Also, you can hold this coin in a hedging strategy. Binance USD allows you to hedge against the volatility of your cryptocurrencies.

Can Investors Mine Binance USD Coins?

No, it is not possible to mine this coin. All the coins have backing by US dollars. This means that there can only be a finite amount of Binance USD coins. Additionally, transaction validation does not happen on-chain.

The fiat backing of this coin requires off-chain record keeping. The Paxos company has to keep track of all the US dollars in circulating supply. Hence, this process requires a centralized bookkeeping process.

Consequently, this discourages transparency. Luckily, this is a regulated process. Therefore, Paxos and Binance cannot lie about how much money they have in the reserve account.

Further, Paxos has the ability to freeze and close accounts. They insist that this is just a regulatory requirement. It is a process meant to discourage the use of Binance USD for malicious activities.

Tokenomics

This coin did not have an ICO, and there are no airdrops. Users have to buy the coin from various exchanges. When you purchase Binance USD coins, Paxos mints new coins to march the amount you are paying. For example, if you spend $500 for BUSD coins, Paxos will mint 500 BUSD coins.

Additionally, Paxos handles the destruction of Binance USD coins. If you redeem your 500 BUSD for US dollars, Paxos will burn an equivalent amount of BUSD coins. Additionally, there will be a reduction of $500 in the Paxos reserve bank account.

The Team behind Binance USD Coins

There is a massive team spearheading the Binance USD ecosystem. This includes team members from both Binance and Paxos. The leader of the Binance team is the CEO, Changpeng Zhao. He has excellent experience in fintech and business. He was a member of the team that launched Blockchain.info.

Further, he was previously the CTO of OKCoin. Behind him is an excellent team of professionals. They have great experience in diverse areas.

Additionally, they are working together with the Paxos team. The leader of the Paxos team is the CEO, Charles Cascarilla. He has excellent experience in business and technology. He is a founding member of ADAM. This is a platform for trading digital assets.

He was also a co-founder of Cedar Hill Capital Partners, an asset management company. He is also joined by experienced individuals on the Paxos team. Therefore, the Binance USD project is in safe hands.

Privacy and Security

The Binance USD project has excellent security features backing it. It runs on two of the safest blockchains in Binance and Ethereum. These blockchains are impenetrable. Additionally, Paxos can cancel transfers in case of an attack. This ensures that funds do not end up in the wrong hands.

Additionally, Paxos holds the fiat currency in a reserved account in a US bank. This process is subject to heavy regulation. Regulators audit this account on a monthly basis to ensure there is no deficiency of funds.

The only security threat is off-chain bookkeeping. Hackers can attack the central institutions that manage the transaction records and make changes as they see fit. Fortunately, that is yet to happen. As it stands, the use of this coin is entirely secure.

Our Take on Binance USD

Binance USD is a very appealing cryptocurrency. It offers a cryptocurrency with price stability. Additionally, it is from two of the most reputable cryptocurrency companies. Binance hosts the biggest cryptocurrency exchanges in the world. On the other hand, Paxos is the world’s leader in digitizing and mobilizing assets.

However, this coin involves a lot of centralization. The two companies behind it have a lot of control in the operations. This is against the original vision for cryptocurrencies. Moreover, centralization introduces a security threat.

Advantages

- The price of Binance USD is stable.

- It allows users to transfer funds very fast.

- Binance USD is very secure.

- Users can use the coin to hedge against crypto assets.

Disadvantages

- It involves centralized institutions.

How to Trade Binance USD Coins

The best way to obtain this coin is by buying it. You can do that on several exchanges that support its trade. These exchanges include Binance, HBTC, Huobi Global, Poloniex, and Hydrax Exchange. The price of one BUSD is $1. You can store your coins in the Binance Wallet. It is safe and easy to use.

This coin currently has a market cap of $822,398,780. This places at 36th in market cap share rankings. Further, it has a 24-hour trading volume of $1,230,753,334. This shows that the coin has excellent liquidity.

Final Verdict

Binance USD is one of the best stablecoins in the market. It has only a little over a year in the markets. But, it is proving to be one of the most popular cryptocurrencies in the market. It is convenient and allows users to transfer funds very fast.

The only issue with this cryptocurrency is centralization. Two institutions have total control of its operations. Nonetheless, this does not seem to be an issue. BUSD has excellent value in the market.

$97,172.00

$97,172.00

$3,109.04

$3,109.04

$1,528.07

$1,528.07

$2,389.10

$2,389.10

$609.61

$609.61

$516.49

$516.49

$294.43

$294.43

$161.98

$161.98

$88.85

$88.85

$157.97

$157.97

$86.66

$86.66

$74.47

$74.47

$76.21

$76.21