Table of Contents

What is the Elliot wave principle?

Elliot wave principle is an effective analysis method used by cryptocurrency traders and Mining Watchdog users, and traders from other industries to identify market trends and repetitive cycles. This principle is developed by breaking down the psychology of an investor and spotting the extreme behavioral trends. The credit for developing it goes to Ralph Nelson Elliott, who understood social norms inflicting decisions in the trading field. In the 1930s, Elliott pitched trends and market prices, which were in the form of waves that led to the Elliot wave principle’s creation.

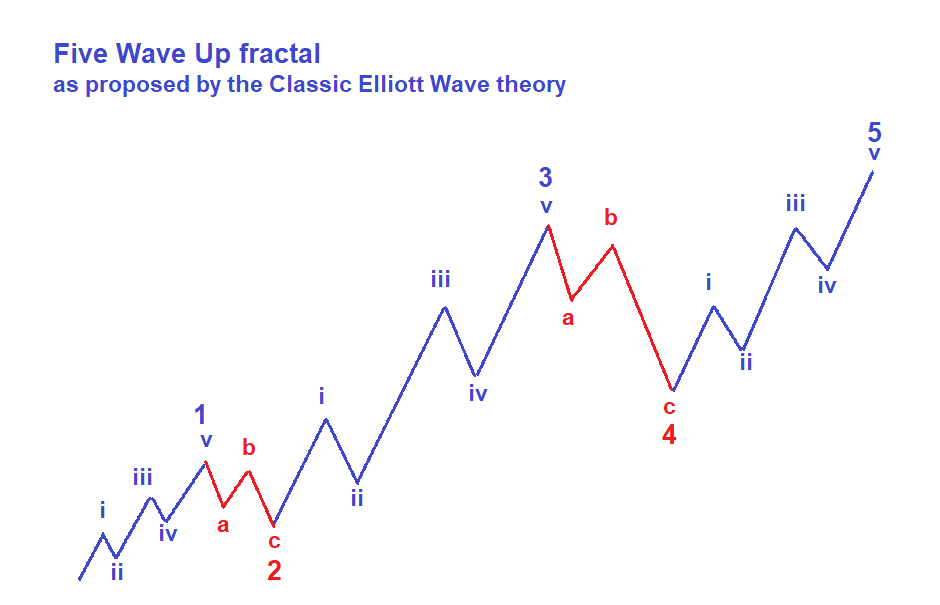

The Elliot wave principle states that investors’ overall psychologies oscillate between pessimism and optimism are generic sequences. It leads to the creation of patterns observed in the movement of the price in the trading market within multiple degrees of time scale and trends. On a given time scale, the prices switch between the motive phase, known as the impulsive phase, and the corrective phase. The impulses further get subdivided into lower degree waves in five sets, which also move between corrective and motive character. Analyzing this, one could see the waves – one, three, and five as impulses, and the waves – two and four are retraces of the waves one and three.

A corrective wave gets further subdivided into three waves, which start with a trend moving in the counter direction, another impulse, and a retrace. When analyzing a bear market, one would notice the downward movement of the dominating trend. The motive waves go along the trend, and in the opposite direction are the corrective waves.

Understanding what each wave signifies

Dominant Trend (Five-wave pattern)

Wave-1

Detecting the first wave at the time of its origin can be tricky. For the same reason, at the beginning of a bullish market in cryptocurrency, most of the news about it is negative. The experts stick to the pre-existing trend and consider it to steer the market. As the economy looks dull, the analysts stick to projecting lower estimates in earnings.

Wave-2

The second wave corrects the first one but is limited to the point of inception of the first one. Overall, it’s likely that the news is still on the negative side. With the prices retesting the previous low, everyone reminds the other how the bear market continues to be ensconced. There are positive signs of picking for those on the lookout, like how the volume tends to be on the lower end in the second wave compared to the first one.

Wave-3

Most likely the most powerful and largest of the lot in the crypto market. The news coming out becomes positive, and crypto analysts begin to raise projections of earnings. The currency prices shoot up, with corrections being shallow and short-lived. It’s by the time wave three reaches its midpoint that the crowd begins to shed the cloak of doubt and pour in their investment in the bullish market.

Wave-4

In the crypto trading domain, wave four is mostly corrective in nature. The volume is a lot less in this part, as compared to wave three.

Wave-5

This is the last part of the transition towards the dominant trend. Universally, the positive becomes prevalent, courtesy of the news highlighting the bullish trend.

Corrective trend (Three-wave pattern)

Wave-A

In comparison to impulse moves, identifying corrections at an early stage can be hard. In the first leg, the news is fairly positive. The drop is seen as a brief correction in a bull market that is still active.

Wave-B

The prices to further high, which is often understood as a resurrection of an already gone bull market. The volume in this wave is lower than the previous one. At this stage, the fundamentals cease to improve and are on the brink of going negative.

Wave-C

The volume goes higher, and by the time this wave is in full swing, it’s no mystery to the world that the crypto market has turned bearish.

The role of Fibonacci Ratios

On the one hand, where Elliott Wave Theory provides structure and form of various price movements in cryptocurrency trading, this theory becomes more effective using Fibonacci ratios or the Fibonacci series. This combination is useful in identifying the trend of price movement and evaluating their potential and the duration it’s going to last.

Leonardo Fibonacci, an Italian mathematician from the 13th century, introduced this concept to the world. The Fibonacci series starts with zero and one and progresses by the summation of the last two numbers. As result, the goes like this – 0, 1, 1, 2, 3, 5, 8, 13, 21, 34, 55, 89, 144 and so on.

The combination of Elliott’s and Fibonacci’s brains can help in developing some key rules that are critical for trading cryptocurrency using Elliott waves. Some of them go as follows:

- Retracements done on Fibonacci ratios indicate levels of demand and supply, in other terms, of resistance and support. The percentage of the prior wavelength helps in determining the corrective levels or potential impulse.

- 168.8% of the first wave is equivalent to the third wave when analyzing a sequence of five waves. The remaining two waves are minor and of almost the same length.

- Following the impulse move emerging out of a significant high or drastic low, the corrective move can be retraced to around 50 – 61.8% of the impulse preceding it.

- The correction in the fourth wave goes up to a maximum of 38.2% of the third wave.

- Because the second wave does not overlap the starting of wave 1, the first wave’s beginning is perfect for placing stops.

How the world uses Elliot Wave Principle

Elliott wave principle received massive success and recognition when Robert Prechter, a market analyst, used the principle to predict the market’s bullish run during the 80s accurately. Many other prominent personalities have also advocated the effectiveness of the graph.

There also have been few criticisms of the Elliott wave principle. The graph’s highly subjective nature can prove to be a bit too vague to put into practical use. The blurred beginning and ending point of the waves further add to the doubt of cryptocurrency market analysts. Some critics have gone as far as to say that this whole theory is a hoax and is nothing but a fictional story.

Where to draw the line with Elliot Wave Principle

Seeing the results in trading from the past, it can be said that the Elliott wave principle is at least helpful in identifying some trend and get an insight, if not more. Every predicted move when buying or selling a Bitcoin might not come true, but it can surely prove helpful in the long run if used with a certain level of consistency. The best way to go about it will be to not solely depend on it when doing forex trading or cryptocurrency trading but to diversify the analysis methods to reach a position where one can make an informed decision. Overreliance on any one method is always advised against, and it’s no different in the case of cryptocurrency trading using the Elliott wave principle.

No Comment