Table of Contents

In the grand scheme of things, if blockchain and cryptocurrency are considered innovations that have changed the finance world, equivalent parallelism exists with cryptocurrency and ASIC. In the early days, solving a block in a Bitcoin blockchain was done easily at home by regular users. Ever since ASIC or Application Specific Integrated Circuits came into the picture, the whole landscape has changed and taken the form of a giant industry, running in sumptuous amounts s of power and electricity, generating a tremendous amount of profits for companies dealing in manufacturing of Bitcoin and other cryptocurrencies mining hardware and equipment.

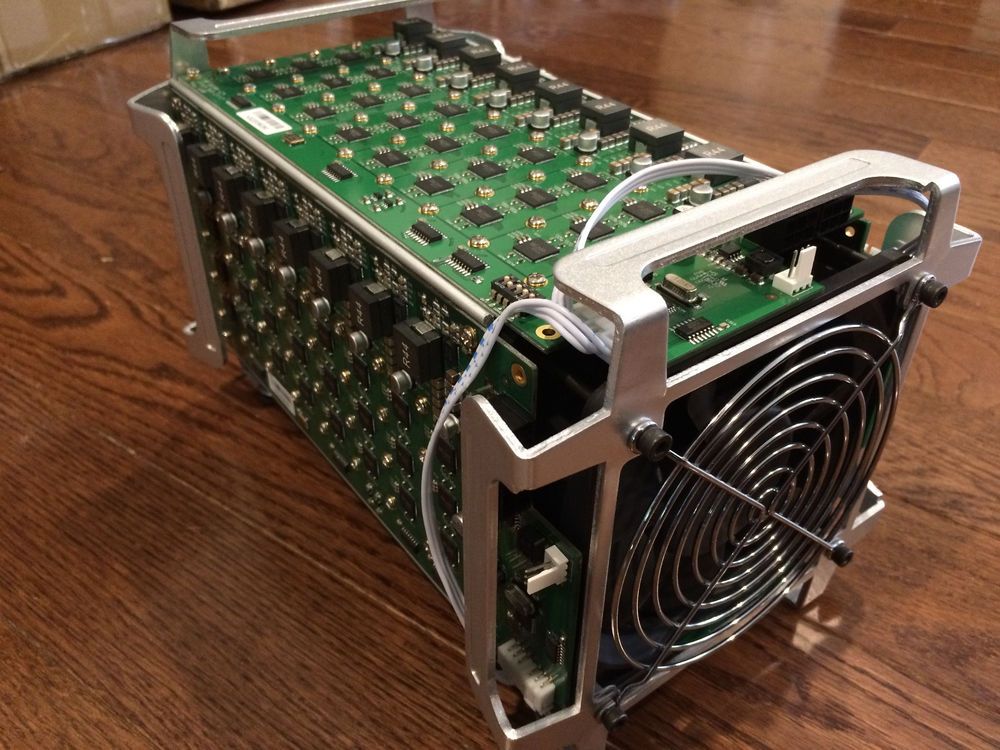

ASIC is a precious device, specifically designed for miners, dealing in the new age cryptocurrency. Any given ASIC miner is designed to perform mining of only a particular currency. For example, a Bitcoin ASIC mining device will uniquely work for Bitcoins. Bitcoin ASICs are considered to be Bitcoin generators or specialized mining computers for Bitcoin.

ASICs are like microprocessors and RAM (Random Access Memory) chips, functioning within a computer. The major difference is that ASIC circuits perform only specific tasks of solely maintaining the blockchain – a publicly available database for storing digital information. Being focused on performing particular tasks compared to regular computers, the device’s cost is on the higher side, owing to the complex mechanism in place, which makes the whole process faster by multiple folds.

How an ASIC Miner works

Being around for decades in various computing devices, ASICs were brought into a newfound application around the year 2013. It was the first time Bitcoin ASICs were manufactured and made available in the public domain. Seeing the positive response and tremendous success, ASIC miners started going into production for various other coins, apart from Bitcoins, like Dash and Litecoin.

In a broad sense, ASICs, GPUs, and CPUs fall under the same category. The major difference between the three being the absence of extra bloat in mining ASICs that helps in making GPUs and CPUs versatile. Playing video games or running multiple operating systems isn’t possible on an ASIC miner, despite the massive power it possesses.

A high resource consuming computing process is colloquially termed as mining. At a fundamental level, it involves reaching the desired solution by doing multiple guesses for numbers, when functioning across hashing algorithms. The correct value thus solves a piece of transaction data involving Bitcoins, successfully adding a block in the blockchain during the process.

The majority of popular cryptocurrencies work on unique PoW algorithms. SHA-256 is the hashing algorithm used by Bitcoin; similarly, CryptoNight is used by Monero, and the PoW algorithm of Ethereum is known as Ethash. Choosing PoW algorithms can be based on multiple factors, but talking specifically in terms of ASICs, it all boils down to the memory requirement. Coins like Monero and Ethereum are considered as ‘memory hard’ coins, unlike Litecoin, Bitcoin, and their infinite derivatives. Being memory hard means, hashing algorithms need a significantly large portion of RAM to run.

What graphic cards and CPUs lack in terms of efficiency, is compensated by them running processes that fill up the memory of the computer with lots of data. ASICs are slowed down by RAM, which means that algorithms making substantial use of RAM, contribute to staving off specialized chips’ influx. Such algorithms are known as ‘ASIC-resistant’ algorithms. Commonly used chips compatible with slow functioning RAM, be it CPUs or GPUs, may keep ticking along.

What works in favor of ASIC Miner?

Bitmain, a multibillion dollar company based in China, rubbishes the claims that ASICs might eventually lead to the centralization of the currency, defeating the whole purpose of why Bitcoin and other cryptocurrencies were created in the first place. To ensure this, Bitmain leads the pack by ensuring that mining rigs’ sales are modulated and preventing a single customer from getting a lot from any new batch.

Many other cryptocurrency experts and miners resonate with Bitmain’s argument and acknowledge the security advantages of allowing ASICs to operate on networks of cryptocurrencies.

Research examining the price of blockchain being taken over in a hostile takeover was presented by an assistant professor from the computer science department of New York University, Joseph Bonneau. ‘Rental attack’ on blockchain was one of the attacks put under the microscope by him. In a rental attack, an entity rents out sufficient computational power for dominating a network of blockchain, from one particular company in the cloud service market space. Bonneau pointed out that the feasibility of an attack like this stands when commodity hardware such as GPUs are used for mining blockchains.

For proof of work blockchains dominated by mining ASICs, an example of which is Bitcoin, a rental attack is not likely. The main reason being the hardware used for Bitcoin mining, which isn’t there for rent, but already accounted for.

Monero, on the other hand, identifies another security advantage of using ASIC miners along with the network. Mining botnets of Monero will get disabled with the use of ASICs. There have been cases of cryptojacking in the past, where leftover CPU cycles are surreptitiously used by a website script. ASIC miners will come to rescue in such events, rendering the whole scam unprofitable, by raising the difficulty levels to such an extent that even with the use of hundreds of CPUs working together won’t be able to compete with it.

Challenges facing ASIC Miners

Bitmain, at one point, gained an unprecedented lead in manufacturing hardware for Bitcoin mining, raising obvious concerns on the security aspect. Over time, with other companies like BitFury and Trezor rising up, there is at least some competition for the Chinese giant. A couple of years back, few researchers identified ‘Antbleed’, a type of vulnerability with the firmware in the Antminers’ product range of Bitmain. By exploiting this vulnerability, some bad actors have the potential to pause the mining done by Bitmain ASICs, eventually leading to crippling the Bitcoin. In the next few days, Bitmain came up with a patch for dealing with the vulnerability, dismissing the whole issue.

The other problem with ASICs getting widely popular is the constantly rising financial barrier of entering into Bitcoin mining. With ASICs working on a network, there is pretty much no room for old players like CPUs and GPUs. As the computational power keeps on shrinking, lesser efficient miners reach a point of complete loss, because the high electricity consumption overshadows the earnings through crypto mining.

The future of ASIC Miner

The way around this problem is either shifting to cryptocurrencies which are yet to be dominated by mining ASICs or go for mining pools. The burden of expenses becomes considerably less when an individual joins a mining pool, naturally, also decreasing the reward share. It will depend on the computing power you are contributing to.

With Mining Watchdog you can compare various mining ASICs across multiple parameters like hash rate, efficiency, power, and more, to find the one best suitable as per your requirement. If experts are to be believed, ASICs are here to stay at least for a few years before they become obsolete. Considering the incredible power they generate and the efficiency of their system, it will take significant research and development to come with a better device.

No Comment